Join one of the leading energy software providers and benefit from our network. Software solutions that support the growth of commodity Brokers, Traders and Exchanges.

Brokers

Showcase your prices to your clients for markets determined by you. Enhance your voice operations to facilitate a hybrid brokerage model for OTC trading.

Traders

View tradable contracts from all your connected brokers and exchange relationships through a single system. Price Transparency at your fingertips.

Exchanges

End to End Solutions to allow Exchanges to cater to their market requirements. Connecting marketplaces within a single platform.

Discover How You Can Access Global Energy and Commodity Market Prices Today

The Trayport Difference

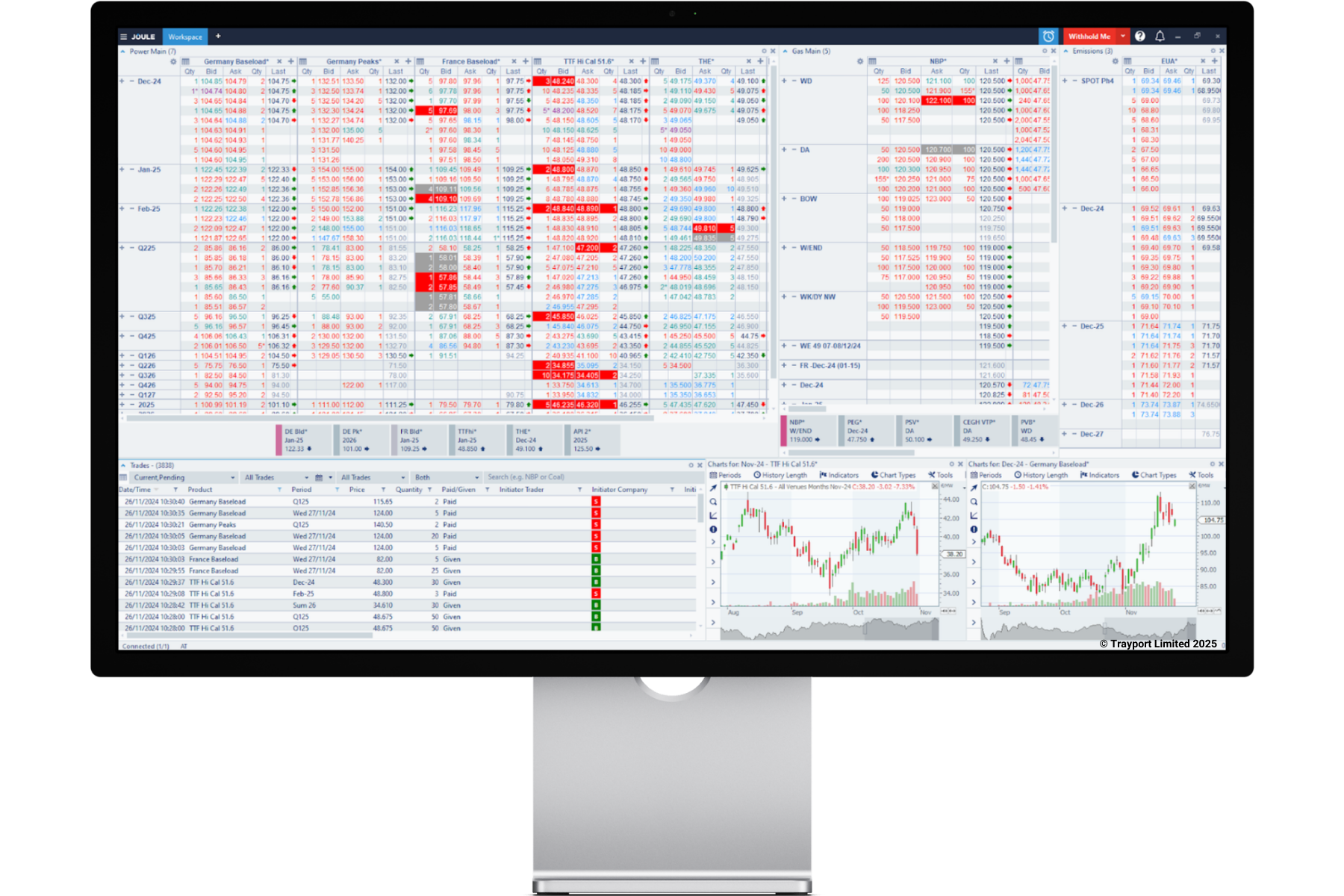

Our focus is providing software for energy trading markets and empowering their development. Our success is underpinned by the strength of our extensive network of traders and venues. We provide easy-to-use, sophisticated market-agnostic trade execution software solutions, one screen that supports global energy and commodity markets including; Gas, Power, Environmental, Freight, Crude Oil and more, all accessible from a single interface.

We connect traders, brokers and exchanges in a single-screen

Access Liquidity in North American Markets

Trayport provide a whole market view to enhance your trading. Combine prices from Nodal Exchange, CME & Velocity providing US Market with European markets for an unparalleled market view and execution opportunities.

Unparalleled Market View & Execution Opportunities

Our software solutions for global commodities markets create an enhanced trading experience across multiple asset classes, OTC, cleared markets and geographies. Our Joule software is an optimally configured screen that consolidates market data. This provides a route to liquidity for market participants to view all their venues in a single stack.

- Simplified best price discovery: viewing multiple price feeds in one easy-to-read price stack

- Complete market visibility

- Accessing contracts from market-leading venues

- Viewing Nodal block trades for Power, Gas and Environmental contracts

Supporting the needs of Brokers, Traders and Exchanges Globally

We provide solutions that connect marketplaces within a single platform. This includes brokers, exchanges, and third-party services such as energy trade and risk management system suppliers and price reporting agencies.

- Access Global energy and commodity markets in a single-screen

- Benefit from transparent pricing based on a per-user licensing fee structure

- View aggregated tradeable market prices in a single stack

- Benefit from over 30 years of experience providing solutions to energy traders, brokers and exchanges globally

How we help Brokers

Solutions for Brokers

Trayport provides brokers with the tools to operate their own online execution venue, including administration tools, order book, credit screening matrix, a matching engine, automated trading tools, and more.

- Voice Brokers – Quickly digitize your business in a simple, cost-effective way

- Screen Brokers – Provision of a sophisticated screen to recognise opportunities for your customers, manage their orders and build liquidity through implied pricing

- Streamline your client’s experience and make it easier for them to trade through you

- You control your own private markets for your clients, and you decide how to run them – from internal whiteboards to trade confirmation/blotters to hybrid voice+electronic markets

- Can facilitate access to thousands of global commodity traders to support the expansion of your business into new markets

How we help Traders

Traders:

- Can aggregate multiple broker and exchange feeds into a single platform and mobile application

- Enable price transparency across global markets

- Use advanced trading technologies that automate trading strategies and enable direct connection to Excel models

- Access our comprehensive API that allows for seamless connectivity to downstream ETRM software for straight-through-processing (STP) of transactions into your internal systems

- Capitalise on our per-user licensing structure, allowing for predictable and manageable costs. Trayport does not charge volumetric trading fees

How we help Exchanges

- Trayport’s Exchange Trading System (ETS) provides exchanges with a single solution for transparent price dissemination, matching of interest and running of orderly markets

- Trayport’s Exchange Trading System is a powerful, real-time matching engine and front-end trading system designed specifically to enable commodity exchanges to host an electronic marketplace.

Next Steps

Learn more about our solutions

Our dedicated North America team are on hand to answer your questions. Complete the form on the right to request more information.